TEDx Cluj

This is a slightly edited version of my June 10, 2023, TEDx...

Read More

Generated with ChatGPT Pro, using Dalle3 option.

Below: A connected...

Read More

Produced by Futurists Gerd Leonhard and Anton Musgrave

“If you work...

Read More

Here are colección de doblajes españoles and Colecções de dublagens...

Read More

We are back for season 2! Previous shows are here.

Watch our short...

Read More

"Synthetic data is information that's artificially manufactured rather...

Read More

Gerd Leonhard Deutsch Technology Humanity Interview August 2023...

Read More

I've been a member of the Millennium Project mailing list for some time...

Read More

My new film LookUpNow has premiered on Youtube.

Here are some useful...

Read More

Greetings dear subscribers, friends, clients and colleagues!This is a...

Read More

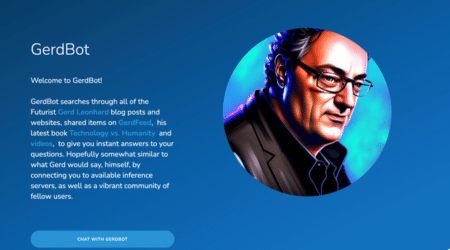

Announcing the launch of TheGerd.AI: Now you can ask Futurist Gerd...

Read More

Gerd Leonhard, Heather McGowan, and Elina Hiltunen filled a day with...

Read More

I'm super-worried after reading Marc Andreessen's latest piece (June...

Read More

Episode #6: About Being a Futurist - What we do

Many have been asking...

Read More

Here's a quick experiment using Generative AI tools such as RunwayML and...

Read More

From Dov Baron's podcast "Leadership and Loyalty"

ChatGPT is an...

Read More

Have a look at these 2 stories, below. The first story, by Ted Chiang and...

Read More

via Future Reports; Roland Berger (Gerd's statements...

Read More